Charging VAT to EU Countries Appropriately

On this page:

- What are the rules around VAT to EU Countries?

- How does your KhooSeller eCommerce website handle VAT?

- 1. EU Order, without VAT number

- 2. Shipped to EU, with VAT number

- 3. Shipped to non-EU, from VAT/non-VAT customer

What are the rules around VAT to EU Countries?

- The EU VAT rules are defined on the gov.uk website here.

- VAT rules are applied if you run your website exc.VAT.

How does your KhooSeller eCommerce website handle VAT?

In short, your website will abide with the VAT rules above. To see how this works in practice, there are a few Order scenarios below:

1. EU Order, without VAT number

Order: From an EU customer, shipped to an EU address, who has not entered their VAT number

Result: Order adds VAT

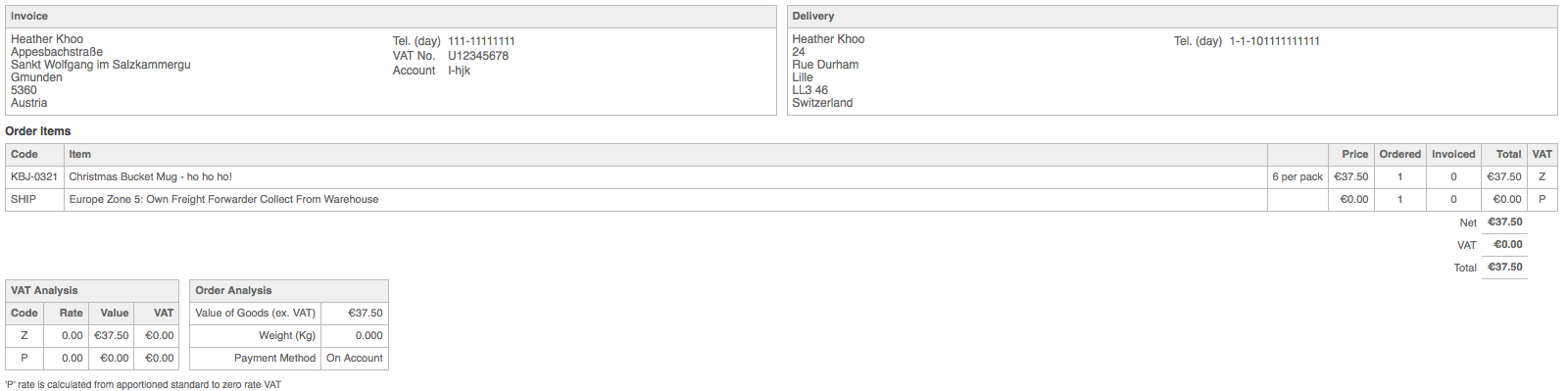

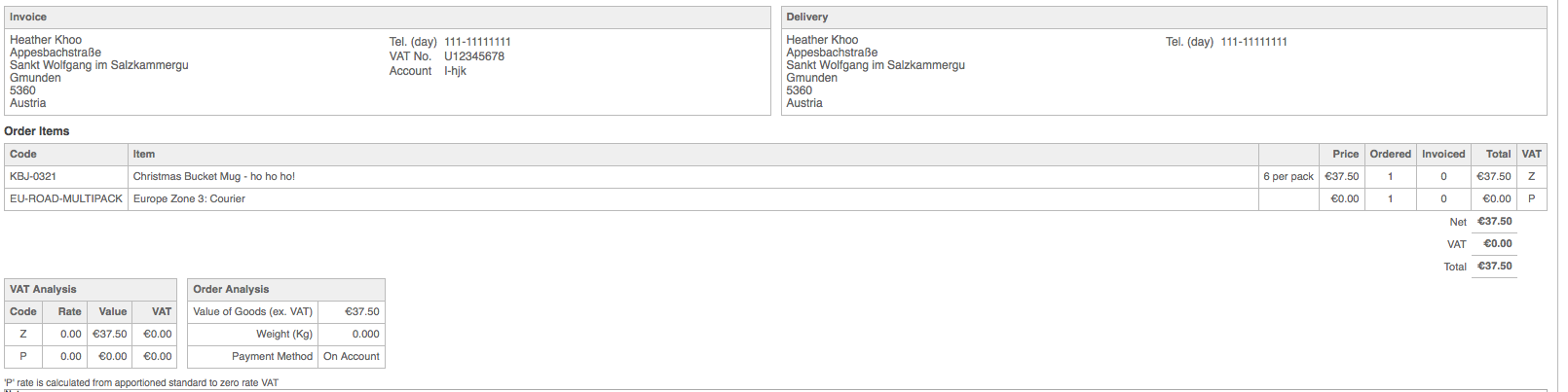

2. Shipped to EU, with VAT number

Order: From an EU customer, shipped to an EU address, who has entered their VAT number

Result: Order adds zero VAT

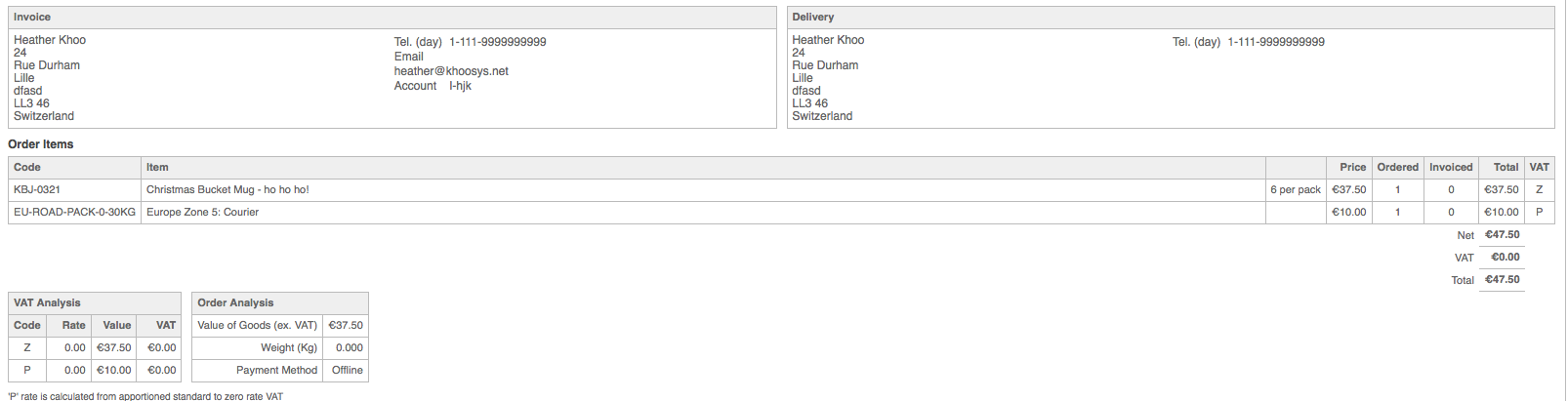

3. Shipped to non-EU, from VAT/non-VAT customer

Order: From a customer (VAT registered or not), shipped to a non-EU address i.e. Switzerland

Result: Order adds zero VAT (Examples below show VAT and non-VAT customer).